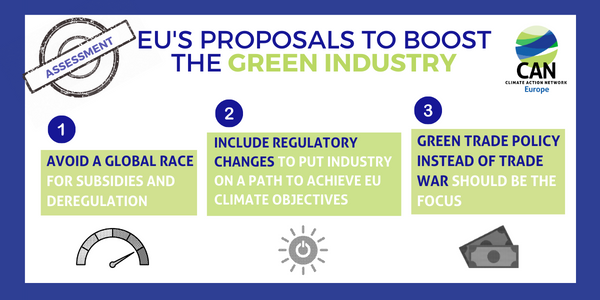

On February 1st 2023, the European Commission is expected to propose a 4 pillar response to the US’ Inflation Reduction Act (IRA), which will be discussed at the upcoming European Council meeting on 9-10 February. CAN Europe welcomes the focus on building a green industry but calls for a number of changes to the package to help rather than hinder the necessary transition of Europe’s economy. Here are our recommendations:

1.Avoid a global race for subsidies and deregulation

There is no doubt we need a massive surge of investments in clean technologies and greening our economy in a socially just manner. However, an adequate response to the IRA should be much deeper and broader than handing more public money to large corporations. In addition, the possible adverse impacts of additional subsidies to European industry on companies from low and middle-income countries who don’t benefit from similar support, needs to be duly taken into account. We therefore call on the EU to:

- Draw lessons from existing EU funds before adopting a new EU sovereignty fund, and make sure all public funding to industry comes with stringent social and environmental conditionalities. Our new briefing highlights the need to fund exclusively genuine green activities, i.e. no nuclear or fossil gas, and outlines the risks of using public funds for subsidising industries that already have plentiful access to private finance, while failing to mobilise sufficient public investment to crucial activities for the green transition, that are typically either underfinanced or not financed at all by private finance.

- Scale up climate finance and technology transfer to developing countries in line with equity to support decarbonisation and a just transition and maintain the dialogue with the USA and other high emitters to do the same. WTO rules notably need to be reformed for all countries to be able to provide financial support for ambitious climate action.

2. Transforming Europe’s industry – Tools missing from the EU response

The EU’s response to the IRA should include a package of regulatory changes to truly put industry on a path to achieve EU Green deal objectives, including climate neutrality in line with the 1.5°C limit and resource and energy consumption reduction. Industries that are genuine climate and environment champions will be the most competitive in the near future. To achieve this we need:

- Increase renewable energy targets to at least 50% and energy efficiency targets to at least 20% in the upcoming trilogues on the Renewable Energy Directive (RED) and Energy Efficiency Directive (EED) to create the right incentives.

- Increase the competitiveness of clean economy businesses by immediately phasing out fossil fuel subsidies, including free allocation of pollution certificates under the Emission Trading System.

- Make investors and corporations accountable for their climate impacts, so that private finance shifts away from damaging economic activities. An opportunity to do so is the upcoming Corporate Sustainability Due Diligence Directive, which must be strengthened and expanded to include climate due diligence and the financial sector.

- Integrate emission limit values for greenhouse gases in environmental permits under the Industrial Emissions Directive (IED) and have a transformation plan before 2030 for each heavy-industry site with a reduction pathway for raw materials and energy consumption.

- Ambitious product requirements with a priority for intermediary products with a high environmental and climate footprint (e.g. steel) under the Ecodesign for Sustainable Products Regulation (ESPR), to boost circular economy and provide additional incentive.

3. Put the focus on green trade policy instead of trade war

The IRA is a move from the USA to fulfil its obligations under the Paris Agreement. In the EU, some politicians and large companies expressed concern about the new subsidies and the fact that some of these are conditioned on local inputs being used in clean tech products. A number of politicians are therefore calling on the EU to sue the US at the World Trade Organisation (WTO). At the same time, the Commission is proposing more trade agreements as an answer to the IRA. CAN Europe calls on the EU to instead:

- Commit to a ‘Climate Peace Clause’, i.e. the promise not to challenge another country’s climate policies for breaches with WTO rules. Instead, disputes should be discussed and resolved in dialogues with partners. Climate rules must be assessed by climate experts instead of trade lawyers that interpret rules from the 1990s, and the specific challenges facing developing countries must be fully addressed.

- Stop signing trade agreements that contradict or restrict the necessary transition of the economy. This includes the EU-Mercosur trade agreement, which incentivises trade in a range of products that fuel deforestation and harm the climate.

- Work to remove restrictions on climate policies enshrined in trade rules, including Investor-State Dispute Settlement (ISDS) (for details see our position paper on trade policy).