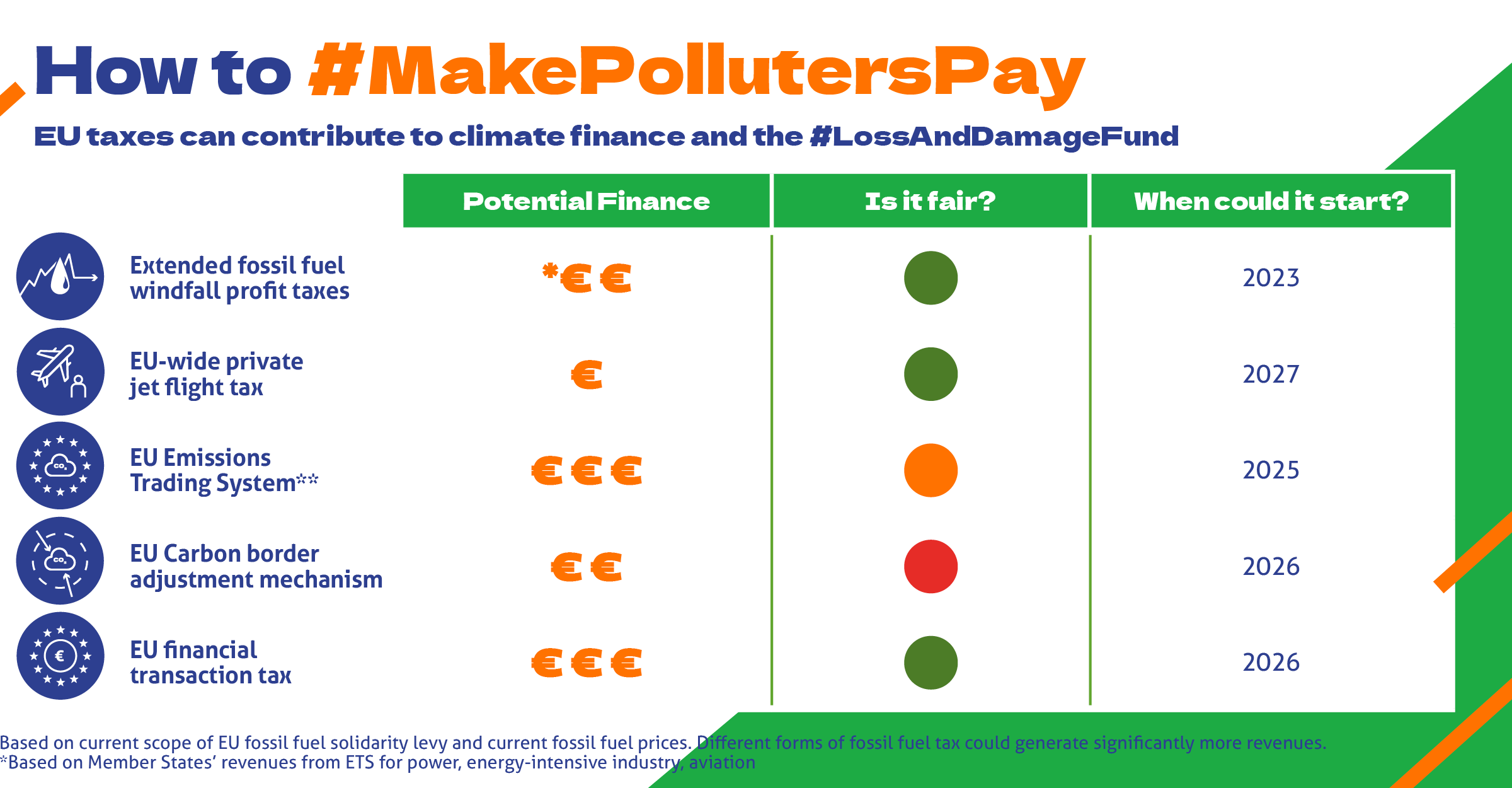

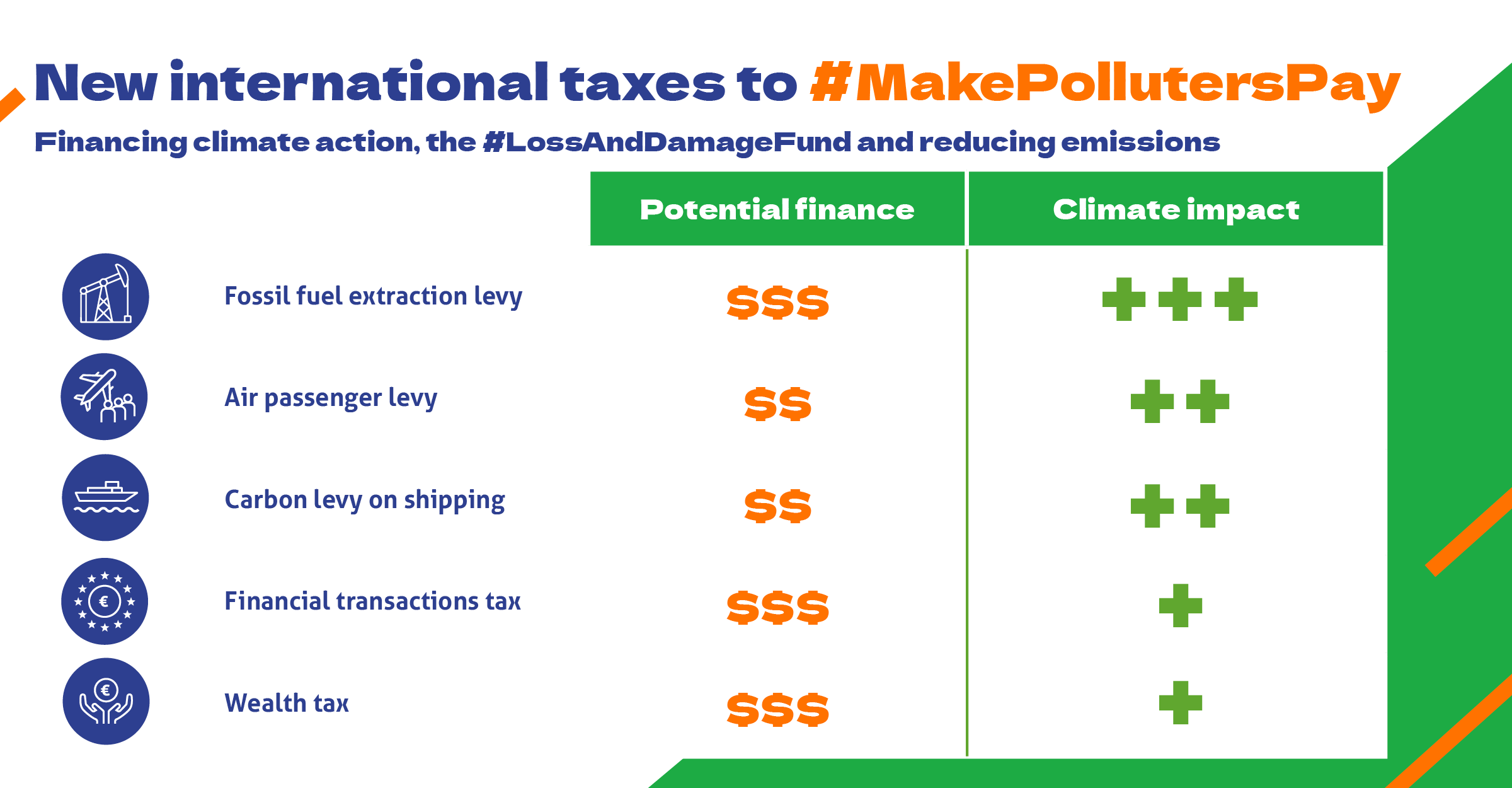

The report provides an overview of main options for scaling up new and additional public climate finance resources, summarizing the

current state of affairs and providing an outlook with regard to new and innovative sources of funding through new and existing policies at multilateral and EU level. A major focus is resources in the EU and developed countries for the Loss and Damage Fund (LDF) and secondarily the new international climate finance goal which will come into operation after 2025.

Firstly the report summarises implementation of taxes and levies through global agreements or multilaterally through coalitions of

‘first mover’ countries, and secondly, by and within the EU. For the majority of options agreement at global level is not considered

feasible in the near term, but the report explores pathways to global implementation and global revenue estimates to show their

desirability.

Key options are explored by financial potential, political and technical feasibility, and compliance with climate justice, namely how they deliver on the polluter pays principle, and how they address global and social equity (inequalities between and within countries).

These climate justice principles can facilitate stronger agreement internationally, and are important for public acceptance. The

report focuses on progressive taxes targeting polluting companies, luxury consumption, finance and wealth. Accompanying regulatory

frameworks are needed to prevent passing on of costs to consumers and workers in a socially regressive way.

DOWNLOAD THE REPORT HERE